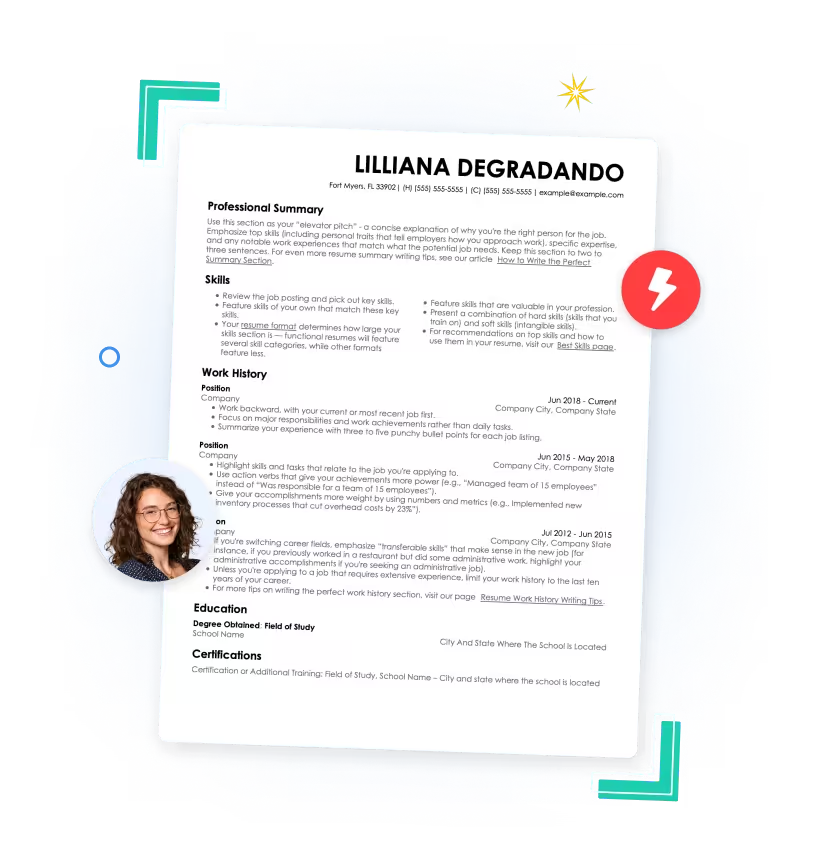

Writing a resume might seem easy enough until you actually sit down to do it. There are a number of challenges, in fact, and it doesn’t help that there is enormous pressure to craft a document that will impress your readers. Fortunately, there are plenty of resources to help you do exactly that; consulting banking and financial services resume samples can help you understand what employers expect. You can model the content and format of your own resume after these examples. Check out the industry-specific tips included, too, for guidance in making your resume a stellar one that can land you multiple interviews.

Banking and Financial Services Resume

1. Bank Manager Resume Sample

1. Bank Manager Resume Sample

WORK EXPERIENCE

Bank Manager

Simpson County Trust

Mendenhall, MS

August 2016 – Present

- Direct general operation of the bank on day-to-day basis

- Train all staff in duties and procedures specific to their positions

- Conduct audits on transactions to verify accuracy

- Manage all deposit and withdrawal records for bank

- Developed ambitious customer acquisition plan that increased profits by 10%

- Improve general reputation of bank and maintain excellent customer service

2. Bank Teller Resume Sample

2. Bank Teller Resume Sample

WORK EXPERIENCE

Bank Teller

Zipline Banking

Boulder, CO

December 2015 – Present

- Manage customers’ accounts and provide one-on-one customer service

- Follow branch procedure for all transactions completed

- Inform customers about bank products that may interest them and suit their financial needs

- Assist customers with transactions such as deposits, check cashing, and withdrawals

- Perform specialty tasks for customers such as opening and closing accounts or transferring funds

- Improved cash count accuracy by 20% through implementation of better training methods

3. Branch Manager Resume Sample

3. Branch Manager Resume Sample

WORK EXPERIENCE

Branch Manager

Teller and Sons Credit Union

Salt Lake City, UT

January 2014 – Present

- Compile quarterly forecasts setting performance goals and expectations for branch

- Maintain financial records relating to all accounts and transactions completed

- Prepare cash slips and deposits for daily and weekly pickups

- Work with vendors to manage account and ensure all transactions are verified

- Developed recruiting approach that greatly improved staff satisfaction and reduced turnover by 30%

- Handle conflicts that may arise regarding customers’ accounts and provide effective solutions to general problems

4. Loan Officer Resume Sample

4. Loan Officer Resume Sample

WORK EXPERIENCE

Loan Officer

Bank of the North

Juneau, AK

April 2012 – Present

- Interact with loan applicants and inform them of different options they may be interested in

- Assess applications and determine general eligibility for loans

- Collect and verify all financial documentation provided by loan applicants

- Approve or deny loans based on criteria established by the bank’s underwriters

- Complete contracts with approved lenders and ensure understanding of loan’s terms

- Worked with lenders to make lending more accessible so that approvals rose by 15%

- Helping denied loan applicants improve their creditworthiness for reapplication in future